Managing multiple debts can be overwhelming, affecting your financial well-being. Enter consolidate debt loans, a powerful tool that streamlines your payments, potentially lowers interest rates, and offers a clear path to financial freedom. Dive into this comprehensive guide to understand the types, benefits, eligibility, and tips for choosing the best debt consolidation loan for your unique situation.

From exploring the various loan options to understanding the impact on your credit score, this guide empowers you with the knowledge to make informed decisions and regain control of your finances.

Contents

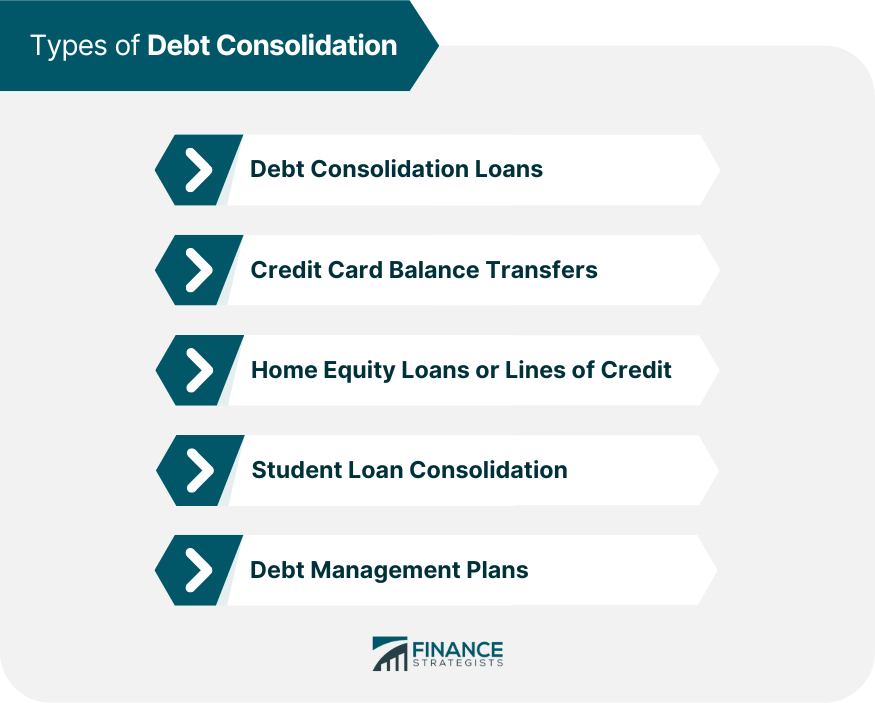

Types of Debt Consolidation Loans

Debt consolidation loans provide a streamlined solution to manage multiple debts, offering various options tailored to individual financial situations.

There are primarily two types of debt consolidation loans:

Secured Debt Consolidation Loans

Secured debt consolidation loans are backed by collateral, such as a home or car. This collateral reduces the lender’s risk, resulting in potentially lower interest rates compared to unsecured loans.

- Home Equity Loan:Utilizes the equity in your home as collateral, providing access to larger loan amounts with lower interest rates.

- Home Equity Line of Credit (HELOC):Similar to a home equity loan, but offers a revolving line of credit that you can draw upon as needed.

- Auto Equity Loan:Uses your car as collateral, offering a loan amount based on the value of your vehicle.

Unsecured Debt Consolidation Loans

Unsecured debt consolidation loans do not require collateral, making them more accessible but typically come with higher interest rates than secured loans.

- Personal Loan:A general-purpose loan that can be used for debt consolidation or other expenses, with loan amounts and interest rates varying based on your creditworthiness.

- Balance Transfer Credit Card:Allows you to transfer balances from high-interest credit cards to a new card with a lower interest rate, potentially saving money on interest payments.

Benefits of Debt Consolidation Loans

Consolidating debt offers several advantages, making it a worthwhile consideration for individuals seeking financial relief. One primary benefit is the simplification of monthly payments. By consolidating multiple debts into a single loan, you can replace numerous due dates and amounts with one manageable payment.

This streamlined approach not only reduces the risk of missed payments but also enhances budgeting and financial planning.Furthermore, debt consolidation loans often come with lower interest rates compared to the original debts. By securing a loan with a lower interest rate, you can potentially save significant money over time.

The interest savings can be allocated towards paying down the principal faster, further reducing the overall cost of debt.While consolidating debt can be beneficial, it’s important to note its potential impact on your credit score. Applying for a new loan may result in a temporary dip in your score, as lenders typically perform a hard credit inquiry.

However, if you make consistent payments on the consolidated loan and maintain responsible credit habits, your score should recover over time. In the long run, the benefits of debt consolidation, such as reduced interest rates and simplified payments, can outweigh any temporary credit score fluctuations.

Eligibility and Qualification for Debt Consolidation Loans

To qualify for a debt consolidation loan, lenders typically consider several factors that assess your financial stability and creditworthiness.

One of the key criteria is your income. Lenders want to ensure that you have a stable income source that can cover the monthly payments on your new loan. They will typically look at your pay stubs, tax returns, or other proof of income.

Your debt-to-income ratio (DTI) is another important factor. This ratio compares your total monthly debt payments to your gross monthly income. Lenders generally prefer borrowers with a DTI below 36%. A higher DTI can make it more difficult to qualify for a loan or result in a higher interest rate.

Finally, your credit history is a major factor in determining your eligibility and qualification for a debt consolidation loan. Lenders will review your credit report to assess your history of making timely payments and managing debt. A good credit score can help you qualify for a lower interest rate and better loan terms.

Income

- Stable income source

- Proof of income (pay stubs, tax returns)

Debt-to-Income Ratio (DTI)

- Compares monthly debt payments to gross monthly income

- Lenders prefer DTI below 36%

Credit History

- Review of credit report

- Assesses timely payments and debt management

- Good credit score can lead to lower interest rates and better loan terms

Comparison of Debt Consolidation Loans

Debt consolidation loans offer various options, each with unique features. To help you make an informed decision, we’ve created a comprehensive comparison table highlighting the key differences among these loans.

The table below compares interest rates, fees, repayment terms, and eligibility requirements of different debt consolidation loan options.

Interest Rates

Interest rates on debt consolidation loans vary depending on factors such as your credit score, loan amount, and loan term. Typically, loans with lower interest rates have stricter eligibility requirements and shorter repayment terms.

Fees

Some debt consolidation loans come with fees, such as origination fees, closing costs, and prepayment penalties. These fees can add to the overall cost of the loan, so it’s important to factor them in when comparing options.

Repayment Terms

Debt consolidation loans typically have repayment terms ranging from 2 to 10 years. Longer repayment terms result in lower monthly payments but higher total interest paid over the life of the loan. Shorter repayment terms have higher monthly payments but lower total interest paid.

Eligibility Requirements

Eligibility requirements for debt consolidation loans vary by lender. Generally, you’ll need a good credit score, stable income, and low debt-to-income ratio to qualify for the most favorable loan terms.

| Loan Type | Interest Rates | Fees | Repayment Terms | Eligibility Requirements |

|---|---|---|---|---|

| Personal Loan | 6%

|

1%

|

2

|

Good credit score, stable income, low debt-to-income ratio |

| Balance Transfer Credit Card | 0%

|

3%

|

12

|

Excellent credit score, low credit utilization ratio |

| Home Equity Loan | 3%

|

Closing costs, appraisal fees | 5

|

Good credit score, home equity |

| 401(k) Loan | 5%

|

Loan origination fee | 1

|

401(k) account with sufficient balance |

Tips for Choosing the Best Debt Consolidation Loan

Selecting the best debt consolidation loan is crucial to managing your finances effectively. Here are key factors to consider:

Interest Rates

Interest rates significantly impact your monthly payments and overall loan cost. Compare offers from multiple lenders to secure the lowest possible rate.

Repayment Terms

Choose a loan with repayment terms that align with your budget. Longer terms typically result in lower monthly payments but higher total interest paid.

Customer Service

Exceptional customer service is vital in case of inquiries or difficulties. Look for lenders with responsive support channels and positive customer reviews.

Fees and Charges

Be aware of potential fees associated with debt consolidation loans, such as origination fees, closing costs, and prepayment penalties. Factor these costs into your decision-making process.

Loan Amount

Ensure the loan amount covers all your outstanding debts while leaving some room for unexpected expenses. Avoid overborrowing to prevent further financial strain.

Ultimate Conclusion

Consolidate debt loans present a valuable solution for individuals seeking to simplify their financial obligations and improve their financial health. By carefully considering the factors discussed in this guide, you can select the loan that aligns with your specific needs and embark on a journey towards financial stability.

Remember, consolidating debt is not merely a transaction; it’s an opportunity to transform your financial future and achieve your long-term goals.