In the realm of personal finance, refinancing student loans has emerged as a powerful tool for borrowers seeking to optimize their financial well-being. Whether you’re burdened by high interest rates, extended repayment terms, or a desire to consolidate multiple loans, refinancing offers a path towards financial freedom.

Throughout this comprehensive guide, we will delve into the intricacies of student loan refinancing, empowering you with the knowledge and strategies to make informed decisions. From understanding the concept and benefits to navigating the application process and managing refinanced loans, we’ve got you covered.

Contents

Understanding Refinancing Student Loans

Student loan refinancing is the process of replacing your existing student loans with a new loan that has different terms, such as a lower interest rate or a longer repayment period. This can be a great way to save money on your student loans, but it’s important to understand the potential benefits and risks before you decide if it’s right for you.

Potential benefits of refinancing student loans:

- Lower interest rates

- Lower monthly payments

- Shorter repayment period

- Consolidation of multiple student loans

Potential risks of refinancing student loans:

- You may not qualify for a lower interest rate

- Your monthly payments may increase

- You may lose certain benefits, such as loan forgiveness or income-driven repayment plans

Key factors to consider when evaluating refinancing options:

- Your credit score

- Your debt-to-income ratio

- The interest rates and terms offered by different lenders

- Your financial goals

Qualifying for Refinancing

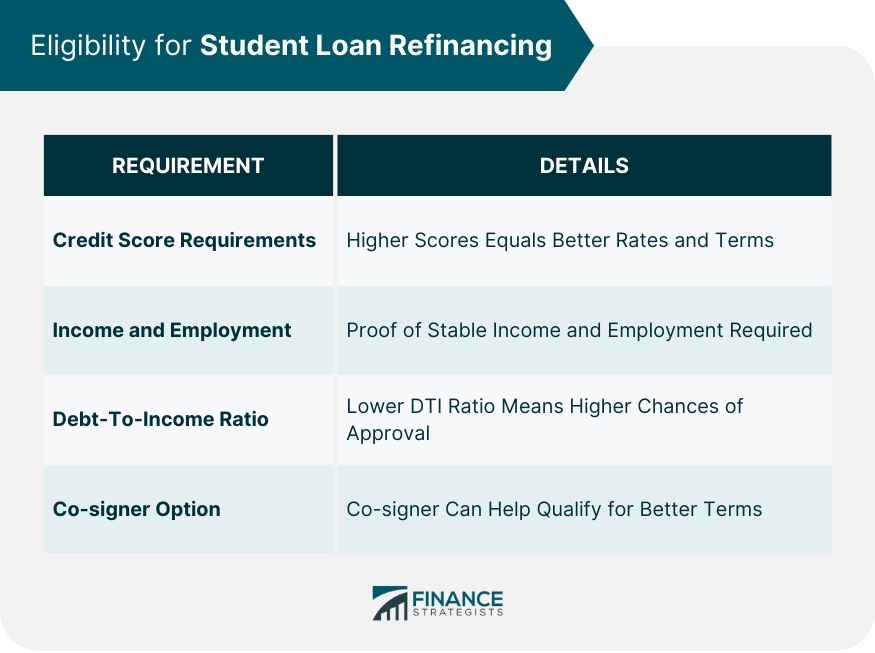

Refinancing student loans is not available to everyone. There are certain eligibility criteria that you need to meet in order to qualify for refinancing.

One of the most important factors that lenders will consider is your credit score. A good credit score indicates that you are a low-risk borrower and are likely to make your payments on time. If you have a low credit score, you may still be able to refinance your loans, but you will likely have to pay a higher interest rate.

Another factor that lenders will consider is your debt-to-income ratio. This is the percentage of your monthly income that goes towards paying off your debts. A high debt-to-income ratio can make it difficult to qualify for refinancing, as it indicates that you may already be struggling to make your payments.

Improving Your Credit Score

If you have a low credit score, there are a few things you can do to improve it:

- Make all of your payments on time, every time.

- Keep your credit utilization low.

- Don’t open too many new credit accounts in a short period of time.

- Dispute any errors on your credit report.

Managing Your Debt-to-Income Ratio

If you have a high debt-to-income ratio, there are a few things you can do to lower it:

- Increase your income.

- Decrease your expenses.

- Consolidate your debts.

Refinancing your student loans can be a great way to save money and improve your financial situation. However, it’s important to make sure that you qualify for refinancing before you apply. By understanding the eligibility criteria and taking steps to improve your credit score and debt-to-income ratio, you can increase your chances of getting approved for refinancing.

Comparing Refinancing Options

Once you have determined that refinancing is right for you, the next step is to compare different refinancing options to find the best fit for your needs. Consider the following factors when comparing lenders:

Interest Rates

The interest rate is one of the most important factors to consider when refinancing student loans. A lower interest rate will save you money over the life of the loan. Interest rates can vary depending on the lender, your credit score, and the type of loan you are refinancing.

Fees

Some lenders charge fees for refinancing student loans. These fees can include an origination fee, a closing fee, and a prepayment penalty. Be sure to compare the fees charged by different lenders before making a decision.

Repayment Terms

The repayment term is the length of time you have to repay your loan. Longer repayment terms will result in lower monthly payments, but you will pay more interest over the life of the loan. Shorter repayment terms will result in higher monthly payments, but you will pay less interest overall.

Reputable Refinancing Companies

There are a number of reputable refinancing companies that offer competitive rates and terms. Some of the most popular refinancing companies include:

- SoFi

- LendKey

- Earnest

- Citizens Bank

- Wells Fargo

Fixed vs. Variable Interest Rates

When you refinance student loans, you can choose between a fixed interest rate or a variable interest rate. A fixed interest rate will stay the same for the life of the loan. A variable interest rate can fluctuate over time, which means your monthly payments could increase or decrease.

There are pros and cons to both fixed and variable interest rates. Fixed interest rates offer peace of mind, as you know exactly what your monthly payments will be. However, variable interest rates can be lower than fixed interest rates, which could save you money over the life of the loan.

Applying for Refinancing

Applying for student loan refinancing can streamline your student loan repayment process. Here’s a step-by-step guide to help you navigate the application process and increase your chances of approval:

Step 1: Gather Necessary Documents

Before applying, ensure you have the following documents ready:

- Proof of Income:Pay stubs, tax returns, or bank statements.

- Proof of Employment:Letter from employer or employment contract.

- Student Loan Statements:Current balances, interest rates, and repayment terms.

- Personal Information:Social Security number, address, and contact information.

Step 2: Choose a Lender

Research and compare different lenders to find the one that offers the best rates, terms, and customer service. Consider factors such as interest rates, fees, repayment options, and lender reputation.

Step 3: Submit an Application

Complete the lender’s online or paper application form. Provide accurate and complete information to support your application. Upload any required documents and submit the application.

Step 4: Underwriting Process

Once you submit your application, the lender will review your financial information to assess your creditworthiness. Factors considered include your income, debt-to-income ratio, credit score, and employment history.

Step 5: Approval and Loan Offer

If approved, the lender will provide a loan offer detailing the interest rate, loan term, and monthly payments. Review the offer carefully before accepting.

Tips for a Strong Application:

- Maintain a good credit score and low debt-to-income ratio.

- Demonstrate stable employment and income.

- Provide clear and organized documentation.

- Be honest and transparent in your application.

Managing Refinanced Student Loans

Once you have refinanced your student loans, it’s crucial to manage them responsibly to avoid default and optimize repayment. This section will provide a comprehensive guide to managing refinanced student loans, including developing a payment plan, handling multiple loans, and strategies for faster payoff.

Developing a Payment Plan

To avoid default, it’s essential to create a payment plan that aligns with your financial situation. Consider the following steps:

- Determine your monthly income and expenses to assess your financial capacity.

- Set a specific payment due date and stick to it.

- Consider automatic payments to ensure timely payments and avoid late fees.

- Explore income-driven repayment plans if you encounter financial hardship.

Managing Multiple Refinanced Loans

If you have refinanced multiple student loans, it’s important to manage them effectively. Consider the following strategies:

- Consolidate your loans into a single loan with a lower interest rate.

- Stagger your loan payments to distribute the financial burden evenly.

- Utilize a loan management platform or spreadsheet to track payments and balances.

- Seek professional guidance from a financial advisor or credit counselor if needed.

Optimizing Repayment Strategies for Faster Payoff

To accelerate loan repayment, consider the following strategies:

- Make extra payments whenever possible, even small amounts.

- Round up your payments to the nearest $10 or $20.

- Consider bi-weekly payments to reduce the number of interest payments per year.

- Explore refinancing options periodically to secure lower interest rates.

Last Recap

As you embark on the journey of refinancing your student loans, remember that knowledge is power. By educating yourself and approaching the process with a strategic mindset, you can unlock significant financial benefits and gain peace of mind. Whether you choose to refinance or not, the insights gained from this guide will serve you well in managing your student debt and achieving your long-term financial goals.