Navigating the world of business financing can be a daunting task, especially for small businesses with limited resources. However, easy business loans offer a lifeline, providing quick and accessible funding to fuel growth and overcome financial hurdles.

In this comprehensive guide, we will delve into the intricacies of easy business loans, exploring their benefits, eligibility criteria, application process, and best practices for effective management. We will also compare different lenders and provide answers to frequently asked questions, empowering you to make informed decisions about financing your business.

Contents

Understanding Easy Business Loans

Easy business loans are a type of financing specifically designed to provide small businesses with quick and accessible funds to meet their operational needs. They are characterized by simplified application processes, flexible repayment terms, and minimal documentation requirements, making them an attractive option for businesses seeking fast and convenient access to capital.

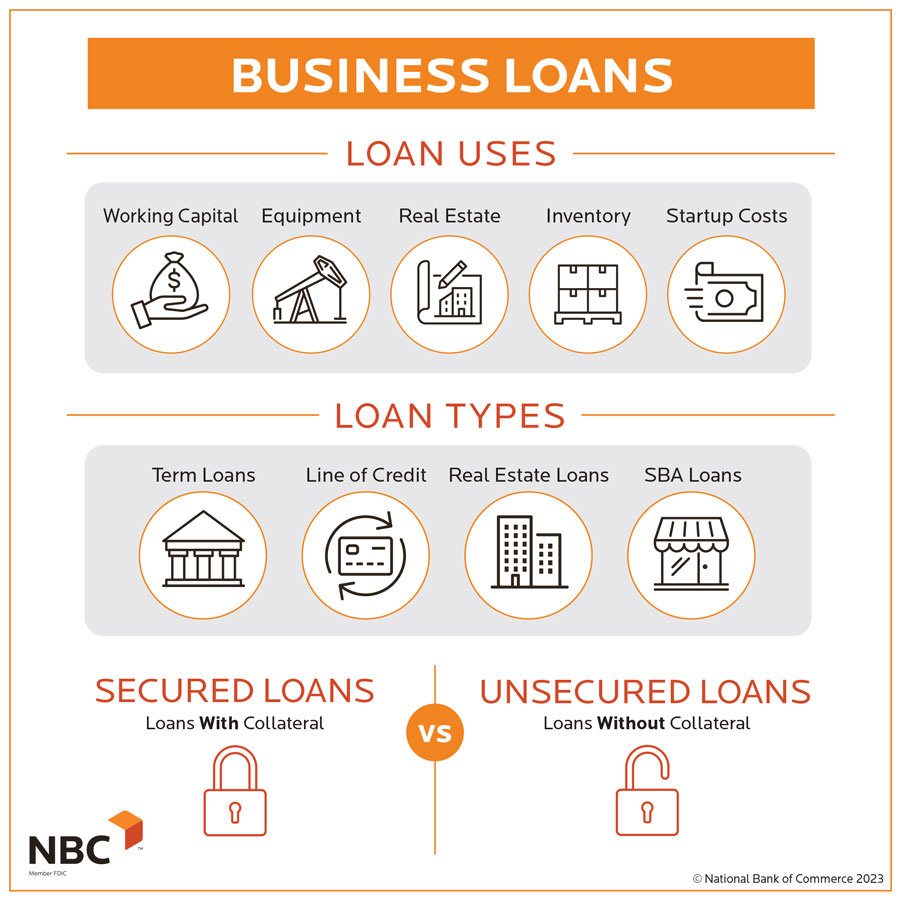

Examples of easy business loan options include:

- Short-term loans: These loans provide businesses with a quick infusion of capital for a short period, typically ranging from a few months to a year.

- Line of credit: A line of credit offers businesses a flexible source of funding that can be drawn upon as needed, up to a pre-approved limit.

- Invoice factoring: This type of loan allows businesses to sell their unpaid invoices to a factoring company for immediate cash, providing them with access to funds that would otherwise be tied up in accounts receivable.

Easy business loans offer several benefits for small businesses, including:

- Quick access to funds: Easy business loans can be approved and funded within a matter of days, providing businesses with the flexibility to address urgent financial needs.

- Simplified application process: The application process for easy business loans is typically streamlined, with minimal documentation requirements, making it easier for businesses to apply.

- Flexible repayment terms: Easy business loans often offer flexible repayment terms, allowing businesses to tailor their repayment schedule to their cash flow.

Eligibility and Requirements for Easy Business Loans

Easy business loans offer accessible funding options for businesses of all sizes. To qualify, businesses typically need to meet certain eligibility criteria and provide specific documentation.

Eligibility Criteria

- Established business:Typically, businesses must be operational for a minimum period, such as 6 months to 2 years.

- Minimum revenue:Lenders may require businesses to have a minimum annual revenue to demonstrate financial stability.

- Personal credit score:Many lenders consider the personal credit scores of business owners as part of the approval process.

- Collateral:Some lenders may require collateral, such as business assets or real estate, to secure the loan.

Required Documentation

- Business plan:A detailed Artikel of the business’s operations, financial projections, and market strategy.

- Financial statements:Income statements, balance sheets, and cash flow statements to demonstrate financial performance.

- Tax returns:Business and personal tax returns to verify income and financial health.

- Business license and registration:Proof of the business’s legal status and legitimacy.

Alternative Options for Ineligible Businesses

Businesses that do not meet traditional requirements may consider alternative funding options:

- Invoice factoring:Selling unpaid invoices to a third party for immediate cash.

- Merchant cash advances:Receiving a lump sum based on future credit card sales.

- Crowdfunding:Raising funds from a large number of individuals through online platforms.

- Government grants and loans:Programs designed to support specific industries or businesses.

Application Process and Documentation

Applying for an easy business loan is a straightforward process. The application typically involves submitting a loan application form and providing supporting documentation to verify your business and financial information.

Loan Application Process

- Gather necessary information:Prepare your business plan, financial statements, tax returns, and personal identification documents.

- Complete loan application form:Provide accurate and complete information about your business, loan purpose, and financial history.

- Submit application:Submit the application form and supporting documents to the lender.

- Lender review:The lender will review your application and request additional information if needed.

- Loan approval:If approved, the lender will issue a loan agreement outlining the loan terms and conditions.

Required Documentation

The specific documentation required may vary depending on the lender, but typically includes:

- Business plan:Artikels your business goals, strategies, and financial projections.

- Financial statements:Balance sheet, income statement, and cash flow statement.

- Tax returns:Personal and business tax returns for the past 2-3 years.

- Personal identification:Government-issued ID, passport, or driver’s license.

- Business licenses and registrations:Proof of business registration and licenses.

Tips for a Strong Loan Application

To increase your chances of loan approval, consider the following tips:

- Prepare a compelling business plan:Clearly articulate your business goals, market analysis, and financial projections.

- Provide accurate financial information:Ensure your financial statements are up-to-date and accurately reflect your business’s financial health.

- Maintain good personal credit:Your personal credit history will be considered in the loan approval process.

- Provide thorough documentation:Submit all required documentation promptly and ensure it is complete and organized.

- Be prepared to answer questions:The lender may request additional information or clarification during the application process.

Comparison of Easy Business Loan Lenders

When choosing an easy business loan lender, it’s essential to compare their offerings carefully to find the best fit for your business needs. Consider factors like interest rates, loan terms, fees, and customer service.

Below is a table comparing key features of several reputable easy business loan lenders to help you make an informed decision.

Lender Comparison Table

| Lender | Interest Rates | Loan Terms | Fees | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Lender A | 5-10% | 1-5 years | Origination fee (1-3%) | Quick approval process, flexible loan amounts | Higher interest rates, limited loan terms |

| Lender B | 3-8% | 2-7 years | None | Competitive interest rates, no origination fee | Longer approval process, strict eligibility criteria |

| Lender C | 6-12% | 1-3 years | Application fee, late payment fee | Short loan terms, no collateral required | High interest rates, additional fees |

| Lender D | 4-9% | 3-10 years | Origination fee (0.5-2%) | Long loan terms, low origination fee | Slower approval process, may require collateral |

Best Practices for Managing Easy Business Loans

Effective management of easy business loans is crucial for businesses to maximize the benefits and avoid potential risks. By implementing smart strategies, businesses can optimize loan repayment, minimize interest expenses, and steer clear of common pitfalls associated with loan management.

Here are some key best practices to consider:

Repayment Planning

A well-defined repayment plan is essential for ensuring timely and consistent loan repayments. Businesses should establish a repayment schedule that aligns with their cash flow projections and financial capabilities. Consider using a loan calculator to determine the monthly repayment amount and interest charges.

Interest Optimization

Exploring options to reduce interest expenses can save businesses a significant amount of money over the loan term. Consider negotiating lower interest rates with the lender, making extra payments when possible, or refinancing the loan at a lower rate if market conditions allow.

Avoiding Pitfalls

To avoid common pitfalls associated with loan management, businesses should:

- Avoid overborrowing: Only borrow what is necessary for business needs.

- Make timely payments: Late payments can damage credit scores and result in penalties.

- Monitor loan terms: Understand the loan agreement thoroughly, including interest rates, repayment schedules, and any additional fees.

By adhering to these best practices, businesses can effectively manage easy business loans, ensuring financial stability and long-term success.

Outcome Summary

Easy business loans are a valuable tool for small businesses seeking to expand, innovate, and achieve their goals. By understanding the eligibility requirements, preparing a strong loan application, and managing your loan effectively, you can harness the power of easy business loans to unlock financial freedom and drive your business forward.